claim workers comp taxes

Workers compensation is in the same category of non-taxable income as the following. The quick answer is that generally workers compensation benefits are not taxable.

Are Worker S Compensation Benefits Taxable In Georgia

In most cases they wont pay taxes on workers comp benefits.

. According to the IRS the answer is no. Consult with an attorney before you file. Under most normal circumstances workers compensation payments are tax-free income for disabled individuals who are unable to work on a temporary or permanent basis.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. The lone exception arises when an individual also receives disability benefits through Social Security disability insurance SSDI or Supplemental Security Income SSI. Also if you are a survivor of someone who received this kind of compensation the payments you get will remain.

The following payments are not taxable. If you didnt deduct medical expenses related to the claim then dont include workers comp in your income. SOLVED by TurboTax 1829 Updated December 23 2021.

From IRSs Publication 525. In general taxes on workers comp benefits are not payable at a state or federal level. Tax Liability for Lump-Sum Settlements.

If the disability is expected to continue beyond the period claimed on the initial CA-7 the employee should complete subsequent Forms CA-7 every two weeks until heshe returns to work on limitedregular duty or until otherwise directed by the WCC or the servicing OWCP office. Unless youre already receiving Social Security Disability Insurance SSDI or Supplemental Security Income SSI benefits. Workers compensation benefits are not normally considered taxable income at the state or federal level.

Unfortunately even tax preparers can get this wrong advising their clients to claim their benefits on their taxes. However a portion of your workers comp benefits may be taxed if you also receive Social Security Disability Insurance SSDI or Supplemental Security Income SSI. Thats because the IRS considers workmans compensation paid under a workers compensation act or statute of a similar nature as fully tax-exempt.

Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements. In fact as far as the IRS is concerned workers comp falls into the same non-taxable category as welfare payments economic damages awarded in a personal injury case please note that punitive damages are taxable any disability benefits for loss of income that are received through a no-fault car insurance policy or recovery for permanent disfigurement or loss of a body part. No you usually do not need to claim workers comp on your taxes.

The following payments are not taxable. Thats because most people who receive Social Security and workers comp benefits dont make enough to owe federal taxes. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

The Workers Compensation Program processes claims and monitors the payment of benefits to injured private-sector employees in the District of Columbia. According to the IRS you do not have to pay income taxes on benefits paid under workers compensation. Unfortunately even tax preparers can get this wrong advising their clients to claim their benefits on their taxes.

Your workers comp wage benefits are generally not subject to state or federal taxes. Your workers compensation payments reduce. Most workers compensation benefits are not taxable at the state or federal levels.

IRS Publication 907 reads as follows. If an insurer is found to cause a considerable delay or is involved in egregious conduct in handling a workers comp claim any interest paid on benefits to an injured worker. Compensation paid by OWCP is not subject to income tax.

But here we go again if you also receive Social Security Disability benefits you may need to include a portion of your workers comp benefits on your taxes. Workers Compensation Benefits Are Not Taxable. Most workers compensation benefits are not taxable at the state or federal levels.

There is no federal or state income tax applied to the weekly receipt of the workers compensation check. Workers compensation is generally not taxable and is not earned income so it would not qualify you for EITC. For example if you took money out of a 401k to subsidize your income while you were receiving workers compensation that distribution may be subject to lump-sum distribution tax.

Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law. Workers compensation up to the amount you deducted for medical expenses related to the claim should be reported as income. If youve received workers comp over the previous tax year you might be wondering whether youll owe taxes on them.

Without getting too technical a tax situation could arise if you receive both workers comp and SSDI. Whether you have received weekly payments or a lump sum federal law does not allow it. In this case you would pay taxes on workers comp.

Workers compensation benefits are payable to individuals who have suffered a work-related injury or illness. On This Page. However retirement plan benefits are taxable if either of these apply.

When filing taxes you do not need to add workers comp to your earned income. The exception says that your workers comp payments may be. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

Should I claim workers comp benefits on my taxes. Wages or retirement plan benefits received count as. In addition lump sum settlements in workers compensation are not.

But there is an exception if youre also getting other disability benefits. An experienced attorney can help you maximize your benefits and make sure you are fulfilling all legal obligations. Read on for the answer.

So even if part of their benefits is taxable its unlikely they would owe anything to the IRS. Workers Comp is Generally Not Taxable. Do you claim workers comp on taxes the answer is no.

The quick answer is that generally workers compensation benefits are not taxable. In some cases the Social Security Administration SSA may reduce a persons SSDI or SSI so. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers compensation act or a statute in the nature of a workers compensation act.

If your tax adviser wants to know the amount you can explain that the benefits are not taxed. Disputes between claimants and employers or their insurance carriers are mediated and employers are monitored to ensure compliance with insurance coverage requirements. Tax Liability from Combined Disability Income.

Surprisingly some tax preparers will ask Of course consult your accountant with tax questions to avoid additional. Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes. Usually the amount ranges from two-thirds to three-quarters of your salary and you get to keep it all.

Is Workers Comp Taxable Workers Comp Taxes

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

Are My Vermont Workers Compensation Benefits Taxed

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Do I Have To Pay Taxes On Workers Compensation

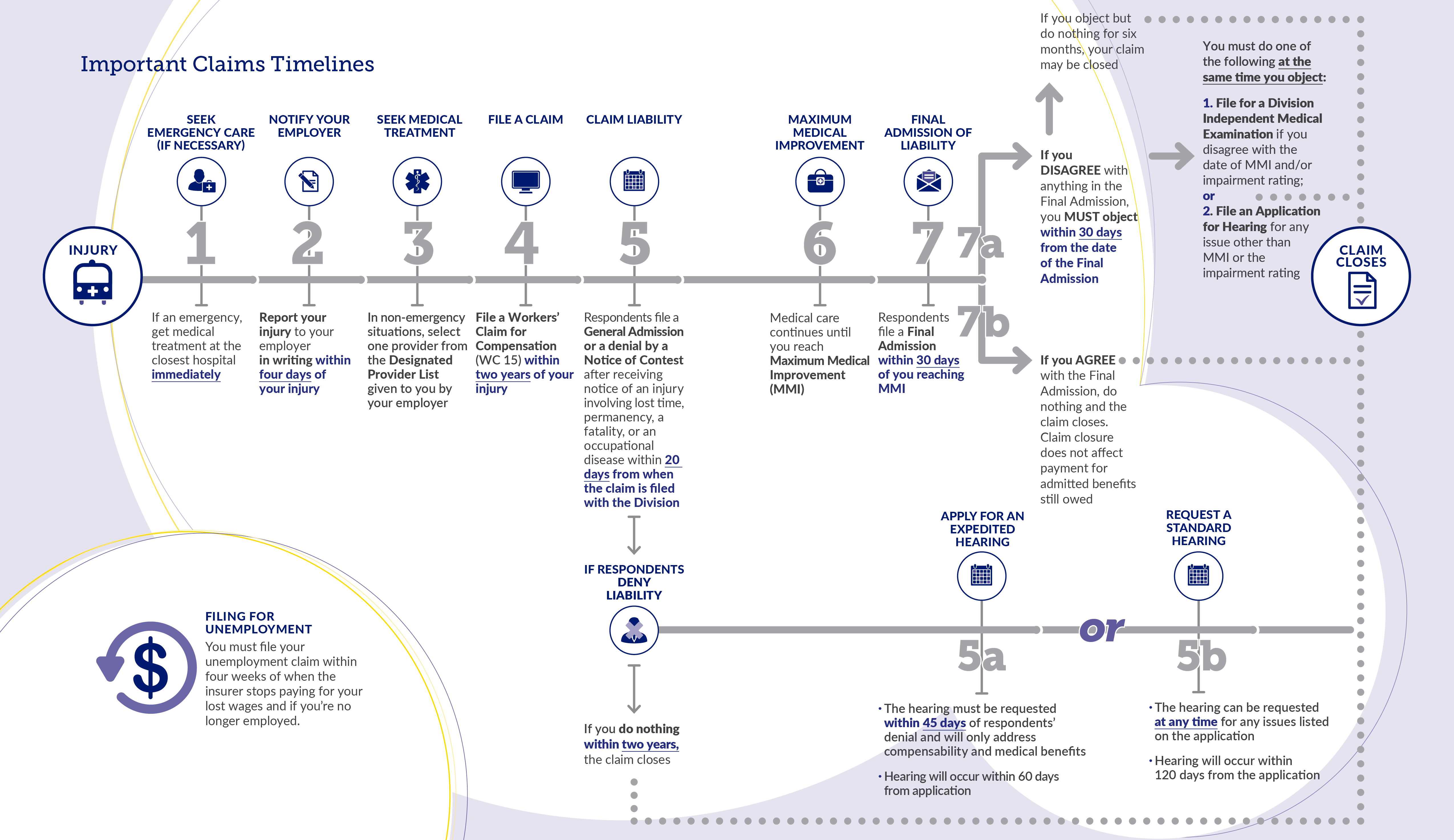

File A Workers Compensation Claim Department Of Labor Employment

Do I Pay Taxes On My Workers Compensation Settlement In Ohio

Are Workers Compensation Settlements Taxed In Montana

Is Workers Compensation Taxable Klezmer Maudlin Pc

When Does Workers Comp Start Paying Benefits Or When They Should

Will My Workers Comp Benefits Be Taxed In California

Is Workers Compensation Taxable In North Carolina Riddle Brantley

How To Deduct Workers Compensation From Federal Tax Form 1040

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Is Workers Comp Taxable What To Know For 2022